The Rise and Fall of Indian Edtech Start-ups

♠ Many edtech start-ups rode the COVID wave and tried to fill the gap by providing online educational services, but the same start-ups are now struggling due to lack of a sustainable business model and high cost of customer acquisition.

♠ In 2021, the edtech industry was valued at $10 billion and is expected to reach $30 billion by 2025.

♠ The Indian government has announced plans to invest $10 billion in the tech sector over the next five years.

♠ Although there have been multiple unicorns in the sector, the number of start-ups that are failing in the sector is also seeing an alarming rise.

In recent years, India has witnessed a remarkable transformation in the field of education, thanks to the rapid growth of its EdTech ecosystem. Because of developments at the intersection of technology and education, new approaches have emerged that are radically altering how we think about education.

A small group of innovators in India’s startup scene in the early 2000s laid the groundwork for the country’s current EdTech landscape. However, the industry has seen significant growth in the last decade. EdTech startups found a welcoming environment in the expanding internet and smartphone markets, as well as among the country’s tech-savvy youth. The market was worth $10 billion in 2021, and experts predict it will be worth $30 billion by 2025. This growth has been driven by a number of factors, including the increasing availability of smartphones and internet connectivity, the growing demand for quality education, and the changing demographics of India.

The Indian EdTech landscape is a diverse ecosystem having a wide range of segments, each addressing specific educational needs like online test preparation, K-12 learning, higher education and skilling, language learning along with coding and STEM education. Startups like BYJU’S, Unacademy, and Vedantu have revolutionized test preparation by offering interactive video lessons, live classes, and personalized learning paths. Platforms like Toppr and Extramarks offer comprehensive study materials, interactive content, and assessments tailored to various educational boards.While Duolingo and Hello English are addressing language barriers by providing engaging language-learning platforms, platforms like Coursera, Udemy, and upGrad are addressing the huge demand of upskilling and reskilling by offering a wide range of courses, from technology to business management, to cater to the needs of working professionals.

With a huge portion of the immense population of India being in the working population or in the school or university attending age, the potential market for the Edtech industry has been huge to say the least. Probably that is why, we were able to produce not one or two but multiple unicorns in the segment like BYJU’s, Unacademy, PhysicsWallah, Vedantu, Eruditus, and upGrad. With offerings including live classes, test prep, and math and coding courses among several others, these unicorns are valued well over tens of billions of dollars and cater to millions of students on a daily basis.

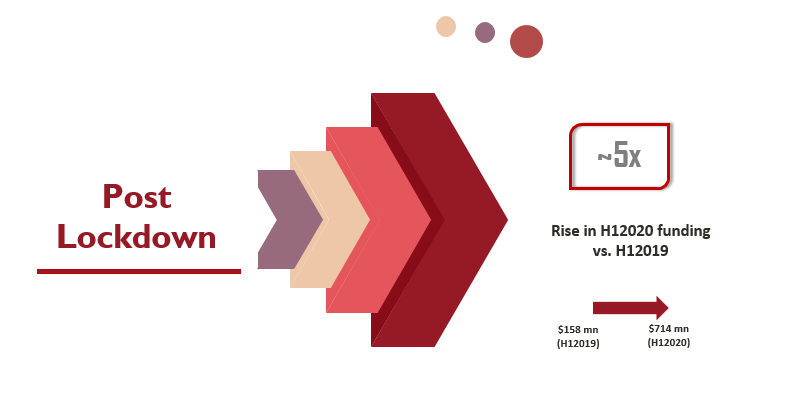

But this space has recently seen few worrisome developments as well. Although there have been multiple unicorns in the sector, the number of start-ups that are failing in the sector is also seeing an alarming rise. Many edtech start-ups rode the COVID wave and tried to fill the gap by providing online educational services, but the same start-ups are now struggling due to lack of a sustainable business model and high cost of customer acquisition.

The recent turbulence in BYJU’s has brought to light some serious issues that not only the company is facing but potential areas of scrutiny of all start-ups. Byju’s has been facing a number of troubles in recent months. These troubles include:

- Not only has Byju’s revenue growth has slowed in recent quarters, but Byju’s has also become infamous for a toxic work environment after several verified reports of allegedly abusive and toxic work culture to unscrupulous sales practices and exploitation of consumers.

- On one hand, Byju’s is burning through cash at a rapid pace and is quickly losing its customer base on the other. The company’s cash burn rate was estimated to be $1 billion per quarter in the third quarter of 2022 while the company’s monthly active user (MAU) base declined by 15% in the third quarter of 2022.

- Several board members and high-profile executives have left Byju’s in recent months. These include the company’s chief operating officer, chief financial officer, and head of marketing.

- The Serious Frauds Investigation Office (SFIO), under the Ministry of Corporate Affairs (MCA), has started a probe to look into various financial irregularities, including delayed financial reporting.

Byju’s value has fallen as a result of these issues. The corporation was once valued at $22 billion, but analysts now place that figure at less than $10 billion. The fate of Byju’s is up in the air. Although it faces many obstacles, the company remains dedicated to its growth ambitions.

The case of Byju’s is just one among many. There are compelling examples at both fronts, the edtech start-ups that have been able to sustain operations effectively and others that haven’t been able to do so. It would be interesting to see where the Indian edtech industry ends up.