Investing in India's Tomorrow: How Angel Networks Fuel Entrepreneurial Dreams

Brief

Angel networks play a vital role in India’s startup ecosystem by providing early-stage funding and enhancing startup credibility. With over 125 active networks and more than 470 startups funded since 2014, their significance is projected to grow further. These networks offer valuable networking opportunities, mentorship, and industry expertise, fostering collaboration and growth.

♠ There are over 125 active angel networks in India, expected to cross 200 by 2030. More than 470 startups have received financial backing from angel networks since 2014.

♠ The role of Angel Networks in the Startup Ecosystem is to provide essential early-stage funding, bridging the gap between startups and investors.

♠ The advantages of Raising Investments from an Angel Network enhance visibility for individual investors and expose startups to a broader network.

Introduction

Imagine this, you have an incredible idea, a vision that could disrupt the market. But there is a hurdle in front of you that you are lacking in funds to implement the same. That’s exactly where ‘Angel Investors’ swoop in. For quick understanding, Angel investors are those benevolent souls who provide much-needed financial backing to startups in their early stages. They believe in the power of innovation and are willing to take calculated risks to support promising ventures with capital. Angel Networks are like a bunch of angel investors teaming up to support startups. They’ve been one of the oldest investor ecosystems in India. As a foundation stone to India’s 60K+ strong startup ecosystem today, the angel networks have played a key role in organizing India’s unstructured angel investing landscape since 2006.

India’s Angel Network Scenario

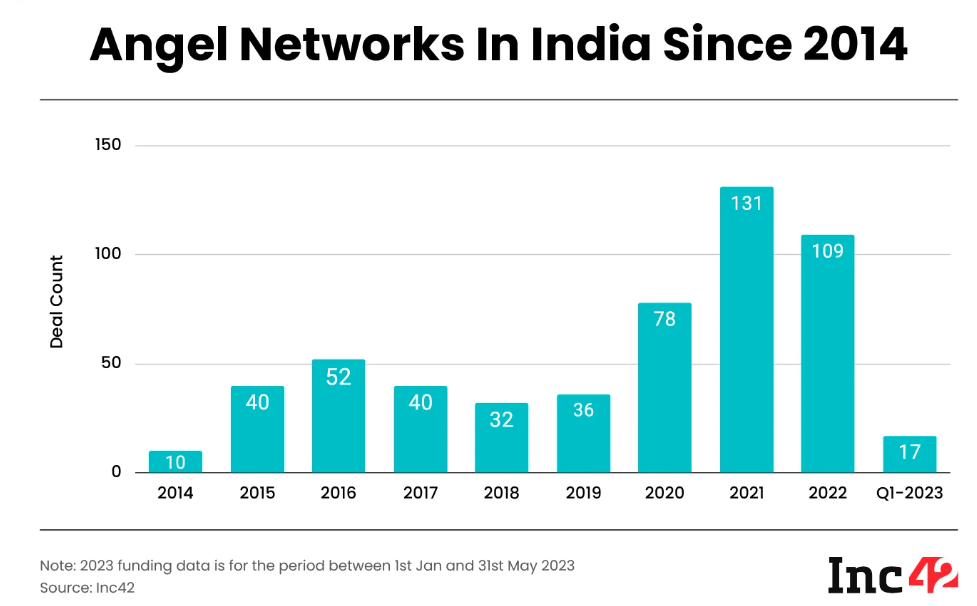

Since 2014, angel networks have provided financial backing to over 470 startups in India. The country boasts a thriving ecosystem of more than 125 active angel networks, comprising both syndicates and platforms. This is expected to cross the 200 mark by 2030. Furthermore, an impressive total of 545 deals have been recorded from 2014 up to the first quarter of 2023, as illustrated in the accompanied graph. This network is estimated to grow at a forward CAGR of 7% between 2023 and 2030.

Role Of Angel Networks in The Startup Ecosystem

Early-Stage Funding: Angel networks are instrumental in providing essential early-stage funding to startups. They bridge the gap between startups and investors who are willing to invest capital, especially when traditional funding sources may be hard to come by.

Enhanced Credibility: Being backed by an angel network boosts the credibility of a startup, making it more attractive to potential investors at later stages. This increased trust can significantly ease the process of raising further investments.

Networking & Other Opportunities: Angel networks serve as valuable networking platforms & other opportunities for startups. By connecting entrepreneurs with like-minded individuals, potential partners, and advisors, they create fertile ground for collaboration and growth within the local startup ecosystem. Moreover, they go the extra mile by providing valuable industry expertise, mentorship, and guidance, enabling startups to overcome challenges and make informed decisions with confidence.

Contribution to the Local Ecosystem: Angel networks actively contribute to the development and growth of the local startup ecosystem. By nurturing promising startups, they play a pivotal role in building a thriving entrepreneurial environment.

The Advantages of Raising Investments from an Angel Network over an Individual

Being part of Angel Networks allows individual investors to enhance their visibility and discover promising startups they may not have come across before. Startups, on the other hand, benefit by gaining exposure to a broader investor network, increasing their chances of finding suitable funding partners. It’s a win-win scenario that fosters valuable connections and opportunities for both parties.

Dealing with multiple individual investors can lead to repetitive negotiations, paperwork, and coordination efforts. Raising funds from an Angel Network simplifies the process because a comprehensive process is conducted only once, thereby saving time and paperwork for both startups and investors.

Angel Networks offer access to a group of investors who, with their collective financial strength, can provide the necessary funds that individual investors may not be able to offer alone. Angel Networks consist of investors from various backgrounds, industries, and experiences. Each investor brings unique insights and expertise to the table. Startups can tap into this diverse knowledge base, receiving valuable advice, mentorship, and guidance. This collective expertise can help the startup make better decisions, and navigate challenges more effectively.

Angel Networks offer streamlined exit options for startups and investors. Once the necessary paperwork is in place, startups need not worry about individual negotiations or exit agreements with multiple investors. This simplicity and cohesion within the network ensure smoother exits and can lead to a more straightforward transition when the time comes.

List of A few Angel Know Angel Networks( in Alphabetical order)

There are many of them who are doing a great job of supporting the entire ecosystem, here is a list of eleven angel networks for founders.

| Name | Logo | Website Link |

|---|---|---|

| Ah! ventures |

|

www.ahventures.in |

|

AngelList India

|

|

www.angellistindia.com |

|

Chandigarh Angels Network

|

|

www.chandigarhangelsnetwork.com |

|

Faad Network

|

|

www.faad.in |

|

Indian Angel Network

|

|

www.indianangelnetwork.com |

|

Lead Angels Network

|

|

www.leadangels.in |

| LetsVenture |

|

www.letsventure.com |

| Mumbai Angels Network |

|

www.mumbaiangels.com |

| Real Time Angel Fund(RTAF) |

|

www.realtimeaf.com |

|

Venture Catalysts

|

|

www.venturecatalysts.in |

| We Founder Circle |

|

www.wefoundercircle.com |

We do not rank anyone; our content is merely for the readers’ information. Write us on team@aicbimtech.com if you want to reach out to network